Sea Pines to appeal verdict

Sea Pines to appeal verdict

Company files to overturn $7.8 million judgment

BY E.J. SCHULTZ, The Island Packet

Published Friday, May 16, 2003

The Sea Pines Co. has filed several motions seeking to overturn the $7.8 million verdict a Beaufort County jury returned against the company in a breach-of-contract lawsuit.

The motions, filed this week, range from a request to have the judge overturn the verdict to an attempt to get a new trial.

In the lawsuit, filed in 1995, Pete Pomranz and Tom DiVenere claim Sea Pines squeezed them out of the TidePointe retirement community project after the two businessmen laid the groundwork for the south-island development, in which Sea Pines was an original partner.

The $7.8 million verdict, which the jury returned April 30, represents lost development fees and ownership stakes the two men say they are owed.

In one post-trial motion, Sea Pines asks the judge to overrule the verdict, claiming Pomranz and DiVenere were not parties to the TidePointe development contract and therefore were not entitled to the $7.8 million award.

Specifically, the motion states that Pomranz never signed the contract, which was finalized in 1991. DiVenere, the motion states, signed the contract only in his capacity as president of Grey Point Associates, a company DiVenere formed earlier that year.

Sea Pines concludes in the motion that Grey Point and Sea Pines were the only parties that signed the contract.

Because the “the jury awarded breach-of-contract damages to two parties … who were not parties to the contract, the verdict and judgment should be set aside,” the motion states.

Sea Pines filed four motions asking for a new trial.

Much of those arguments center on the $7.8 million verdict, an amount Sea Pines says is “excessive” and without justification.

Of the $7.8 million verdict, $4.94 million was awarded to the two businessmen as compensation for their lost ownership stake in the project, according to the Sea Pines filing.

The 1991 contract, according to the plaintiffs suit, called for Grey Point to own one-third of TidePointe.

In the motion, Sea Pines states that the “jury awarded the plaintiffs $4.9 million for a one-third interest in an asset that Sea Pines sold for a $1.35 million loss.”

The 1998 sale to Classic Residence by Hyatt occurred after Sea Pines’ majority partner in TidePointe, P.I.E. Financial Corp., was taken over by regulators. Regulators stepped in after the Ohio company was found to be $275 million in debt.

Sea Pines states in the court filing that its stake in the partnership with P.I.E. was worth $2.35 million.

The $1.35 million loss came after the company sold its $2.35 million share for $1 million, according to the court filing.

Finally, in one motion, Sea Pines describes the verdict as “punitive and not compensatory in nature.”

The motion cites a “vicious and inflammatory closing argument” by one of the plaintiffs lawyers, whom the motion states labeled (Sea Pines) as “crooks and liars.”

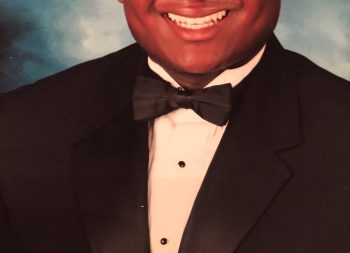

One of the plaintiffs lawyers, Richard Rosen, said last week that he expects the verdict to stand.

“I think it’s a fair verdict based on the evidence,” Rosen said.

Rosen, president of the SC Bar Association, made the comments after a speech he gave to the Hilton Head Island Rotary Club about the importance of juries to the American justice system.

Sea Pines President Mike Lawrence said Thursday that the post-trial motions “present our side of the case,” adding, “hopefully the judge will take it under consideration.”

A hearing date has not been set, Lawrence said.

Contact E.J. Schultz at 706-8137 or eschultz@islandpacket.com.