What is Personal Injury Protection?

Personal injury protection insurance, also called PIP or no-fault insurance, pays a policyholder’s medical expenses regardless of who is responsible for an accident.

Although this coverage is optional, it can provide much-needed financial relief without worrying about fault.

As with any sort of insurance coverage, however, actually compelling the insurer to pay what it promised can come with its challenges.

You may also have a claim against the other driver if you were not at fault.

The basics of personal injury protection coverage

First things first: what is personal injury protection, or PIP?

It is often called no-fault insurance, and that’s a good way to think of PIP.

If you have automobile coverage and you are injured in an accident, your insurer will pay for the medical expenses regardless of who caused the wreck.

Because this coverage is optional, having it will increase your premium payments.

But for many South Carolina drivers, PIP is a lifeline in a time of crisis.

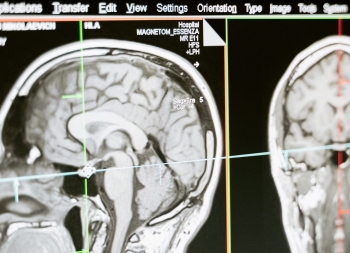

What do “medical expenses” include?

This is a broad term that covers losses such as surgical procedures, dental care, medical supplies, and prescription medications stemming from the accident. Your policy will provide details of this coverage, or you can ask a South Carolina personal injury attorney.

Does personal injury protection coverage pay for other expenses?

Depending on your policy, your PIP insurance may pay for other losses such as lost wages resulting from your injuries. It may also cover funeral expenses if the accident victim dies. Again, check your specific policy language or ask an attorney to learn more.

What are the benefits of personal injury protection insurance?

Depending on the law of the state in which the policy is written, the advantages of having this coverage typically include:

- Payment for your medical bills as well as those of your passengers

- Payment for medical expenses even if you were responsible for the accident

- If you were not at fault for the accident, PIP pays you in addition to (not in place of) the at-fault party’s liability insurance coverage

- It usually pays sooner than the at-fault driver’s insurance coverage

- It will pay sooner if you have to sue the at-fault driver for negligence

What are some problems that personal injury protection insurance holders may have?

One of the advantages of personal injury protection coverage is that it pays more quickly compared to the at-fault driver’s insurance.

It also pays much sooner than a judgment from a personal injury lawsuit. However, your insurer may drag its feet when you need payment quickly for medical and related expenses.

Another potential problem that is common to all types of insurance: what if your insurer denies a perfectly valid claim?

Perhaps your insurer doubts the legitimacy of the expenses or falsely claims the coverage lapsed. In any event, this is adding insult to injury at a time when you need your insurance company to do its job.

A skilled South Carolina personal injury attorney can work through these and other roadblocks.

Your lawyer can also help you hold the other driver accountable if that individual caused the wreck.

Remember, personal injury protection insurance is in addition to whatever an at-fault driver is ultimately required to pay.

So, you may be able to sue for other damages such as lost wages, lost earning capacity, pain and suffering, and much more.

Do you have questions about personal injury protection insurance? Did the other driver negligently cause your accident?

Rosen Hagood is here for you. Our experienced and dedicated personal injury team can answer questions you have about insurance and get to work on building a claim against the at-fault driver.

For a free consultation, call (843) 577-6726 today or complete the form below.

[wpforms id=”6783″ title=”false”]