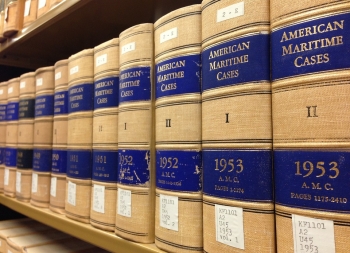

How To File a Creditor’s Claim Against a South Carolina Estate

If a person who owes you money passes away, you will likely need to make a claim in probate court to recover your money. Certain deadlines and procedures have to be followed in order for you, as a creditor of the estate, to successfully collect on the debt. Rosen Hagood’s probate, estate, and trust litigation attorneys are here to serve you and answer any questions you may have about probate.

One of the most important things for a creditor to know is that there is a deadline to file a claim against an estate. In South Carolina, to collect from the estate, a creditor must file their claim either before 60 days from the mailing of the Written Notice of Creditors (sent by the estate’s personal representative) or 8 months from the first publication of the Notice of Creditors in the newspaper, whichever is later. All claims against the estate are barred if not filed with the probate court within one year of the date of death.

To be on the safe side, it’s a good idea for a creditor to present its claim as soon as possible, which is accomplished by filing a written statement with the probate court. Known as a Statement of Creditor’s Claim, the form contains pertinent details about the debts the decedent owed to the creditor.

Those details include:

- The identity and contact information of the creditor

- The amount of the debt (or, the nature of any uncertainty as to the amount)

- Identifying information about the debt, such as an account number

- The nature of the debt; for instance, whether it was for services rendered

- The date the debt will become due if it hasn’t already

- A description of any security as to the claim

Having this information organized and ready to file is essential to ensuring the deadline to file isn’t missed. An attorney can help you prepare and file the appropriate documents.

The estate’s personal representative has certain duties with respect to estate debts, which could trigger further necessary action by the creditor. All creditor claims must be resolved before the estate is closed in probate, and in any event within 14 months after the date of death. There are three methods this may be done:

- Negotiate the claim with the creditor. The personal representative can discuss the amount with the creditor to see if a compromise can be reached for a lower amount.

- Pay the claim. The personal representative can simply pay the amount claimed by the creditor.

- Disallow the claim. The personal representative can file a Notice of Disallowance to object to creditor claims, either in whole or in part. The representative will have to properly serve this notice on the creditor.

If the creditor receives notice from the personal representative that it does not intend to pay the debt, the creditor has 30 days to take legal action if it wishes to collect.

A creditor should act quickly to ensure the estate pays the decedent’s debts. If an estate owes you money or other assets, don’t delay taking action. Let the experienced probate, estate, and trust litigation team at Rosen Hagood assist. Give us a call today.