Palmetto ABLE Accounts Help Brain Injury Victims Save and Invest More

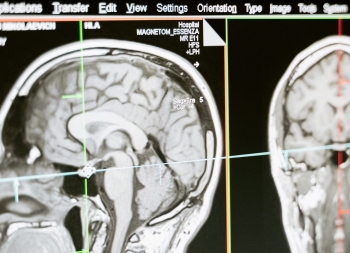

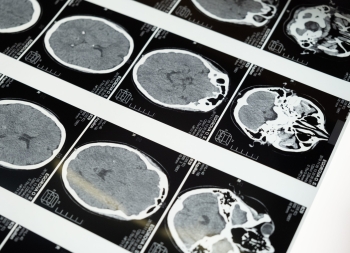

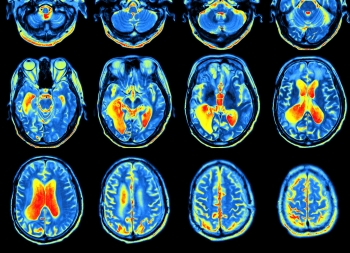

As part of Rosen Hagood’s ongoing focus on Brain Injury Awareness Month, we turn to practical tips to help brain injury victims keep their monthly disability benefits while saving and investing. A brain injury victim who receives a large settlement for his or her injuries may be at risk of losing support from programs like Medicaid. That’s where a Palmetto ABLE account can be useful.

The Palmetto ABLE account is an investment vehicle for eligible individuals with disabilities, including brain injuries. The account shares some similarities to a checking or savings account, but is not a traditional bank account. Instead, the individual can use the account to save and invest money without losing public benefits. Money held in the account is not subject to state or federal income tax as long as it’s spent on Qualified Disability Expenses.

These accounts are comparable to a 529 college savings account or a 401(k) retirement account. The money is deposited into an ABLE account and invested in a number of different options. The money can later be withdrawn or spent, but can also remain in the account for long-term growth. The funds can also be used for disability related expenses as needed.

An expense is considered a Qualified Disability Expense if all of the following apply:

- The individual incurred the expense at a time when he or she was eligible for the ABLE account;

- The expense is related to the individual’s disability; and

- The expense helps the individual to maintain or improve his or her health, independence, or quality of life.

These are a few common examples of Qualified Disability Expenses:

- Basic necessities like food, clothing, and personal care items

- Housing costs, including mortgage payments, rent, and utilities

- Transportation expenses such as the purchase of a vehicle or mass transit costs

- Education expenses like tuition, books, and supplies

- Assistive technology devices, software, and services

- Employment training and support

- Health-related expenses like insurance premiums, long-term care, and therapy

It’s important for the individual to document how the money is spent in case of an IRS audit. If money is spent on a non-qualified expense, it is subject to income taxes plus an additional 10% tax on the earnings portion. Non-qualified expenses can also count against the individual for determination of that person’s eligibility for public assistance programs. Consult with a tax professional for guidance on the tax implications of using ABLE account funds for qualified and non-qualified expenses.

The money can also be saved and invested in the ABLE account, using a number of available options. Palmetto ABLE provides five different investment portfolios to choose from:

- Growth

- Moderate growth

- Conservative growth

- Income

- BankSafe

These options each have different strategies related to capital appreciation and income. Palmetto ABLE does not provide investment advice, and the individual would need to speak to an investment professional to learn more. Generally, however, the account holder would want to know about expected risk and potential return with each portfolio.

Accounts are free to open and can be done so with a minimum deposit of $50.00. There is a monthly maintenance fee of $3.50, and an asset-based fee of between 0.19% and 0.33%, depending on the investment options chosen by the account holder.

Our goal at Rosen Hagood is to help brain injury victims get the compensation they deserve after being injured. For many brain injury victims, Palmetto ABLE accounts provide the perfect combination of investing and saving so they can keep more of their money while not jeopardizing access to public benefits. If you or a loved one has suffered a brain injury and want to know more about your legal rights, reach out to us today. If you’d like to learn more about Palmetto ABLE accounts, visit https://palmettoable.com/.